Some Of Mortgage Broker

Wiki Article

Mortgage Broker Things To Know Before You Buy

Table of ContentsThe 7-Second Trick For Mortgage BrokerThe smart Trick of Mortgage Broker That Nobody is DiscussingA Biased View of Mortgage Broker6 Easy Facts About Mortgage Broker DescribedThe Ultimate Guide To Mortgage BrokerThe Greatest Guide To Mortgage Broker

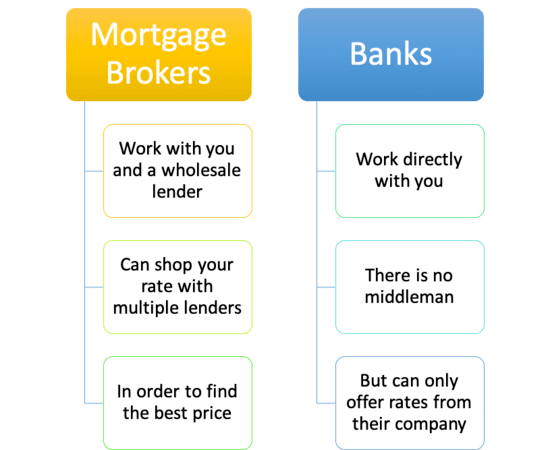

They can undergo all their lender partner's programs to find the best suitable for you, and hopefully the ideal prices too. They may locate that Financial institution A provides the lowest price, Bank B uses the lowest closing expenses, and Financial institution C has the best feasible mix of rates and also fees.

And also who wishes to look for a mortgage more than as soon as? The number of banks/lenders a home loan broker has accessibility to will certainly vary, as brokers must be accepted to function with each separately. A person who has actually been in the organization a very long time may have developed a large number of wholesale companions to pick from.

Getting My Mortgage Broker To Work

They may additionally advise that you limit your financing total up to a conforming amount so it complies with the guidelines of Fannie Mae and also Freddie Mac. Or they might recommend that you damage your finance right into a first and bank loan to avoid mortgage insurance coverage and/or obtain a far better combined price - mortgage broker.If you have negative credit scores or are a real estate capitalist, brokers may have wholesale mortgage companions that specialize in home loan car loans just for you. They might not work on the retail degree, so you 'd never ever understand concerning them without your broker intermediary. A retail bank might simply provide you generic lending selections based on the loan application you submit, without any more understanding in regards to structuring the offer to your benefit.

Mortgage Broker Things To Know Before You Buy

If you know you're looking for a specific kind of finance, seeking out one of these specialized brokers can lead to a better end result. They may additionally have partners that stem jumbo mortgages, thinking your funding amount surpasses the adjusting finance limitation. When all the information are settled, the broker will certainly submit the funding to a lender they function with to gain authorization.Borrowers can select if they intend to pay these expenses at shutting or through a greater interest rate. Ask your broker to plainly discuss both choices prior to continuing. What they charge can differ greatly, so make certain you do your research before agreeing to collaborate with a home loan broker. And ask what they bill before you apply! Home Mortgage Brokers Were Blamed for the Housing Dilemma, Brokers obtained a whole lot of flak for the recent real estate situation, Especially considering that agented mortgage showed greater default prices, About home fundings stemmed via the retail banking channel, However eventually they just marketed what the banks were providing themselves, Home loan brokers were mainly criticized for the home mortgage situation because they originated finances in support of countless financial institutions and also weren't paid based on funding efficiency.

Per AIME, brokers have historically not been provided the recognition they are entitled to for being specialists in their field. Home Mortgage Broker FAQLike all other car loan producers, brokers bill origination costs for their services, and their charges may differ commonly. It costs cash to run a mortgage broker agent, though they may run leaner than a large financial institution, passing the financial savings onto you.

Mortgage Broker - Truths

If they aren't charging you anything directly, they're simply obtaining paid a broker payment by the loan provider, suggesting you'll wind up with a higher rate of interest price to make up. Make certain to check out all alternatives to obtain the most effective combination of price and also fees. Not necessarily; as pointed out home mortgage brokers can supply competitive rates that fulfill or defeat those of retail financial institutions, so they should be taken into consideration along with banks when looking for financing.Additionally, brokers must typically complete pre-license education and some should take out a bond or meet certain net well worth needs. Yes, home mortgage brokers are controlled on both the federal and state level, and must abide with a lot of guidelines to conduct business. In addition, customers have the ability to search for broker documents through the NMLS to ensure they are accredited to perform service in their state, and to see if any activities have actually been taken against them in the past.

And despite the ups and downs that come with property, they will certainly probably remain to play an energetic function in the home mortgage market due to the fact that they give an one-of-a-kind service that large financial institutions as well as debt unions can not mimic. While their numbers may change from time to time, their websites services need to always be readily available in one method or another.

Facts About Mortgage Broker Uncovered

Using a home loan broker such as not only makes audio financial sense, but will give you with all type of crucial aid. So, you're searching for home mortgage offers to aid you buy a property, however with many home mortgage companies as well as home mortgage lending institutions out there, it can be difficult to understand where to start.Trying to do without a home mortgage broker would be a blunder as mortgage broker benefits are clear. Making use of a home mortgage broker such as Loan.

Conserve you cash A home mortgage broker will certainly search the offered mortgages for you and also take a look at the his comment is here most effective bargains. This isn't just a case of looking for the most affordable home loan rates today, or the most inexpensive tracker home loan or most affordable fixed price home loan. A proficient mortgage broker has the ability to look beyond the home mortgage rates of interest to consider all the various other charges that will use.

The Buzz on Mortgage Broker

4. Give you experienced financial suggestions Mortgage brokers have to be certified to aid you locate a mortgage as well as give you monetary recommendations. They are also have a Read More Here responsibility of like offer you the most effective guidance they can, instead of simply press the option that will provide them one of the most appoint.Care for the application documents The world of home loan funding contains lingo and tedious documents, however the professionals at Car loan. co.uk will deal with all that difficult work for you. They'll prefill your mortgage application for you so your new home mortgage can go as smoothly as possible.

Report this wiki page